TAX FREE RETIREMENT

When it comes to retirement planning, many of us try to find ways to preserve our hard-earned wealth while minimizing our tax liability. We also try to find ways to participate in market gains while minimizing losses. Unfortunately, most of us do not have the proper financial education to know where to allocate our money that will allows us to do just that.

When we talk about Retirement Planning, our mindset is trained to think of financial plans such as a 401(k), Traditional IRA, or company Pension Plans. These plans are mostly created by employers with the intent of benefiting the employee, and they are called "Qualified Plans".

Qualified Plans

Qualified Plans are designed to offer individuals added tax benefits on top of their regular retirement plans, such as IRAs. Employers deduct an allowable portion of pretax wages from the employees, and the contributions and the earnings then grow tax-deferred until withdrawal. But let's look at a few reasons why we need to become better educated on how these plans work:

Qualified Plans are designed to offer individuals added tax benefits on top of their regular retirement plans, such as IRAs. Employers deduct an allowable portion of pretax wages from the employees, and the contributions and the earnings then grow tax-deferred until withdrawal. But let's look at a few reasons why we need to become better educated on how these plans work:

- Pre-tax wages are those that have not been taxed yet. The taxes on these wages are tax-deferred meaning that you pay tax at the time of your retirement when you are ready to take distributions.

- These plans mainly have you investing directly into the stock market via mutual funds where your potential for gains is high, but so is your potential for losses.

- There are limits to how much of your money can be contributed into these plans, and in some cases you may not qualify if your Modified Adjusted Gross Income (MAGI) is over a certain amount.

- You cannot take withdrawals prior to the age of 59 1/2 without incurring an IRS early withdrawal penalty and you MUST take mandatory distributions by the age of 70 1/2 or you will be subject to a very high tax penalty.

So, to recap, Qualified Plans allow you to contribute Pre-tax dollars, potentially deduct contributions from taxes, Tax-Deferred growth, and give you the potential for market gains.

The downfall is that it exposes you to RISK of losing money in a down market, limits how much you can contribute, higher income earners may not qualify for certain Qualified Plans, and the potential for being at a higher tax bracket in the future exists which would mean a higher tax liability in the future than what that liability would be today.

Nothing about these plans give you TAX FREE RETIREMENT! Let me show you another option for retirement planning that you may not know about that can give you Tax Free Retirement.

The Tax Free Retirement Concept

There are four key factors today that will impact retirement:

- Social Security

- The National Debt

- Taxes

- The Stock Market

Take a look at the above tax chart. Even with the tax increase in 2012, the top federal income tax rate is at 39.6%. The highest tax rates in our history were around 94% during WWII. So historically speaking, we are still at a low tax rate.

But the problem is this: with the current state of our economy, unemployment is still high, our National Debt continues to rise at a rate of $1 Trillion/yr for the past 5 years, and our government's belief that we do not have a spending problem but a revenue problem, the potential is definitely there for our tax rates to be higher in the future than what they are today. If that is the case, then why DEFER taxes to a later time when we may possibly be at a higher tax rate then? Wouldn't it make more sense to just pay taxes today while our rates our still low that to defer into the future?

Pay Tax on the Seed or Pay Tax on the Harvest?

Take a look at the above chart. On the left side, it shows you the Qualified Plan approach:

- No tax paid on initial contributions into those plans (the small black box: Pre Tax money).

- Money grows Tax Deferred (the large green area).

- Contributions are invested into mutual funds or other securities that expose you to stock market risk of loss.

- Contributions are limited to a maximum amount.

- At the time of retirement, 100% of all funds in those plans are TAXABLE.

- This is called "Paying Tax on the Harvest." You "planted" your seeds (contributions), let your seed (contributions) grow tax deferred, then at the time of harvest, you PAID TAX on the entire harvest.

Now tale a look at the above chart on the right side. It shows you the Tax Free Retirement approach:

- Pay tax on the initial contributions into this plan (small black box: After Tax money)

- Money grows Tax Deferred (the large green area)

- Contributions give you Safety of Principal with guarantees, Protection Against Loss in a market downturn, and Tax Free distributions.

- For the most part, your contributions to these plans are not limited.

- At the time of retirement, you can take out distributions TAX FREE.

- This is called "Paying Tax on the Seed". You paid tax on your seeds (contributions), let your seed (contributions) grow tax deferred, then enjoyed your entire harvest TAX FREE!

So what is this product that gives us Safety of Principal with Guarantees, Protection Against Loss in a Down Market, and Tax Free Distributions at the time of retirement? It is called Indexed Universal Life. Look at the chart below for a comparison of what happened to your money when invested in the stock market versus allocating your money into an Indexed Universal Life...

The Stock Market vs. Indexed Universal Life

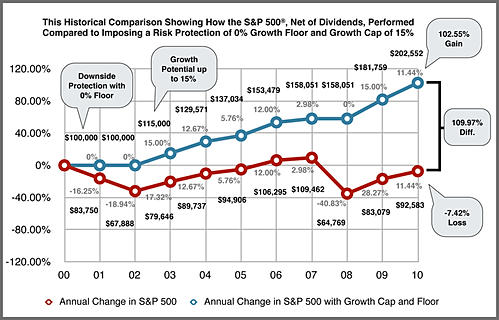

The graph above shows the opening year

numbers for the S&P 500 from January 2000 through the closing

numbers of December 2010. As you can see with the blue and red lines,

the red line indicates the actual returns of the S&P 500, while the

blue line represents Indexed Universal Life product with a 0% Floor and a 15% cap.

This Indexed Universal Life was able to zero out all of the negative years

because of the 0% floor, and although the 15% cap does not allow you to

benefit from 100% of all market gains over 15%, you still outperformed

the S&P 500 with a 102.55% return vs. -7.42% loss. That means if you

invested $100,000 into an Indexed Universal Life product vs. investing that

same $100,000 directly into the S&P 500, the difference after 10

years would be $202,552 for the Indexed Universal Life product vs. $92,583 for

the S&P 500, a difference of $109,969 or 109.97%! The Indexed Universal Life product allowed you to eliminate two key factors that affect

your retirement:

The Stock Market and Taxes.

So, the choice is yours. Do you trust your

hard-earned retirement money into the stock market that gives you opportunities

to participate into 100% of all gains as well as the risk of

participating into 100% of all losses, or do you allocate your money

into an Indexed Universal Life product that protects you from all risk with a 0% floor and

allows you to participate into market-like gains with a 15% cap?

So to recap about the Indexed Universal Life product with Tax Free Retirement strategy:

- Create a Tax Free Retirement

- Benefit From the Upside Gains In The Market Without the Risk of Market Downturn (Safety of Principal With Upside Potential)

- Have "Peace of Mind" Knowing Your Retirement Money Is In One of the Safest Savings Vehicles Available Today

- If Properly Funded, A Guaranteed Lifetime Stream of Income

- Provide Heirs With An Instant Estate, Tax Free

- AND NOW, Full Living Benefits Where You Can Acces Your Policy's Benefits While You Are Still Alive in the Event of a Chronic, Critical, or Terminal Illness, and Disability

Now that you know that there are options for your retirement planning that give you safety of principal with guarantees, protection against market downturn, tax free retirement distributions, and now living benefits, the time to get started is NOW!

You have to qualify for this product since it is life insurance. Qualifications include age, health status, family health history, and occupation to name a few. The earlier you start, the more time you will have for your money to compound and grow. Also, more of your premiums paid into the insurance policy will be contributed into the cash account since the cost of insurance is less the younger and healthier you are.

Do not procrastinate! Let's get started now to see where you qualify. Contact me for a quote to get your future Tax Free Retirement started TODAY!

John L. Nunes

President & CEO

J. Nunes Financial

john.nunes@jnunesfinancial.com

510-629-3568